According to the fourth-quarter portfolio structure results released on the morning of November 15, MSCI added 14 stocks to the MSCI Frontier Market Index basket. CTR stock is one of 06 Vietnamese stocks (along with CEO, EVF, KOS, SIP, VPB) selected by MSCI. In the opposite direction, 2 Sri Lankan stocks were eliminated. The MSCI Frontier Market Index portfolio has now grown to 211 tickers.

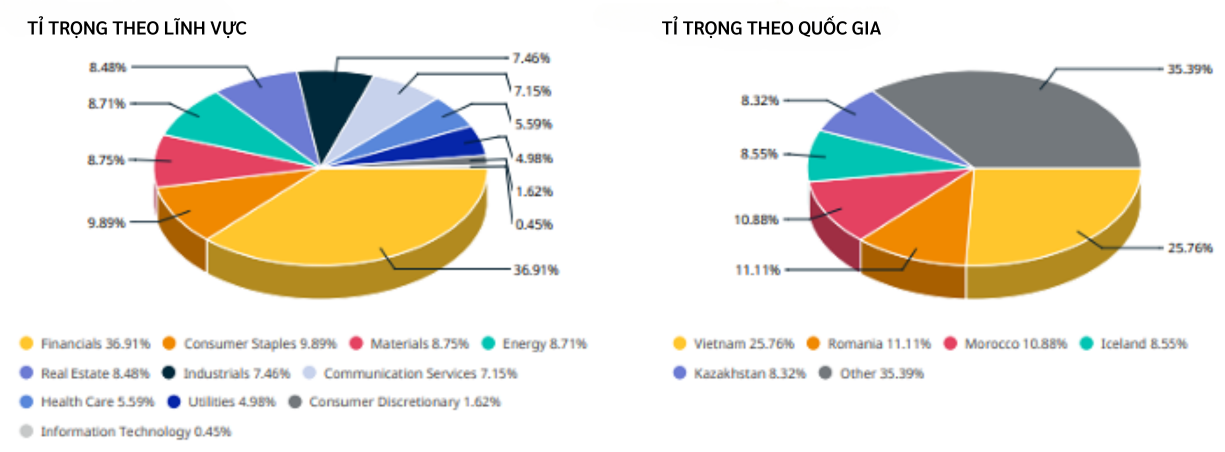

At the end of October, Vietnamese stocks accounted for the largest proportion in the MSCI Frontier Market Index at 25.76%. Next are Romania and Morocco with rates of 11.11% and 10.88%.

The top 10 stocks with the highest proportion in the MSCI Frontier Markets Index as of October 31 had 4 codes from Vietnam: HPG, VNM, VCB and VIC. HPG holds the highest proportion at 4.17%, being the third largest stock in the portfolio.

For the MSCI Frontier Market Small-Cap Index, the portfolio is added 48 codes and 17 codes are added. The Vietnamese market had 7 codes added including LHC, TVS, VFS, PVT, VNS, IDV and YEG, while CEO and EVF were eliminated to move to the MSCI Frontier Market Index basket.

The changes will take effect Dec. 1. The next review will take place on February 12, 2024 CEST, which is dawn on February 13, 2024 Vietnam time.

BOX:

MSCI – Morgan Stanley Capital International is an investment research firm specializing in providing stock indices, portfolio risk, performance analysis and governance tools to institutional investors.

MSCI Frontier Markets Index is currently the most important index among MSCI's frontier market tracking indexes when there are quite a few active funds with a scale of hundreds of millions of USD using this index as a standard, possibly including Schroder International Selection Fund, Templeton Frontier Markets Fund, Morgan Stanley Institutionam Fund, Magna Umbrella Fund...

Credit: CafeF, Fireant.