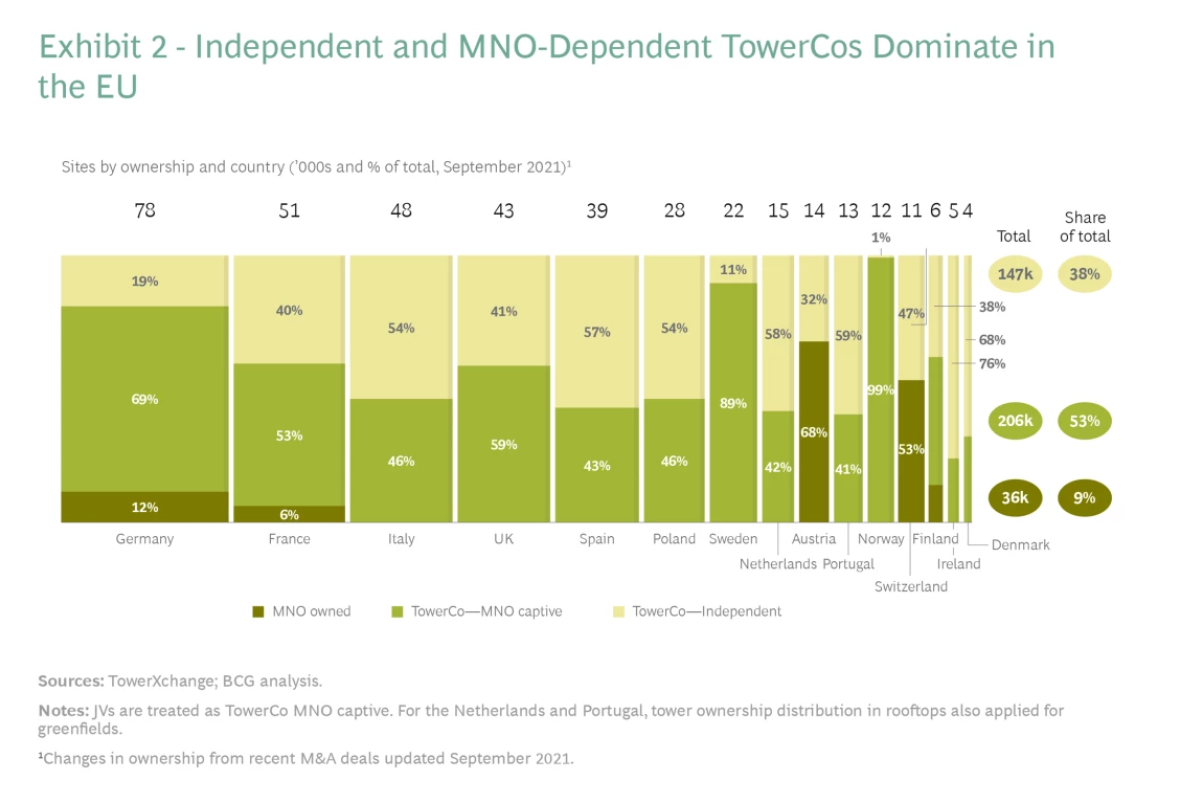

BCG believes that the telecommunications industry is still tending to specialize between TowerCo and the network operator. It seems that the carriers do not realize the benefits from exploiting the infrastructure, but they only focus on bringing better digital services to the community, responsible for connecting businesses and society.

World TowerCo market share clearly dominates in the telecommunications industry

The analysis results of BCG have shown that TowerCos belong to the group of top value companies in the telecommunications industry. TowerCos were far ahead of carriers in terms of average annual shareholder returns. TowerCos have increased their “average total return to shareholders” over the past five years by 24%, nearly double the industry average total shareholder return of 13%, and more than three times total return to The average shareholder aggregates 7% of the carriers. While, the telecommunications operator's 5-year average total shareholder return has only improved slightly, from 6.3% in 2019 to 7.2% in 2021. This comes from the fact that TowerCo has a model simple business model, high profit and more stable cash flow than the carriers.

On that basis, the TowerCo has attracted many investment funds to pour capital or buy back ownership in independent business units. In addition, funds are actively investing in companies that own fiber optic cables, data centers and undersea cables for telecommunications networks.

In contrast, the traditional carriers in the world are trying to find new values, as the price of telecommunications restrictions increases. Many carriers have refrained from raising prices during the pandemic, when the world depends on carriers to stay connected. Experts estimate telecom companies have lost billions of dollars in revenue from lower roaming fees when people stopped traveling. At the start of the pandemic, revenue from traditional services fell 3%, despite a 47% increase in internet traffic.

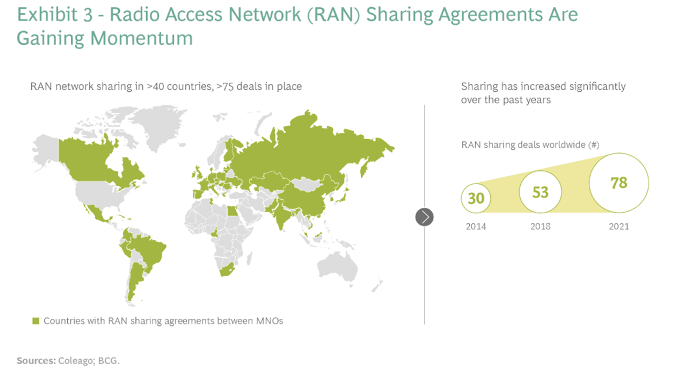

The trend of sharing and sharing network infrastructure in more than 40 countries in the period 2014-2021. (Source: Coleago, BCG).

BCG believes that the TowerCo will continue to improve the network, coverage and service. Capital invested in TowerCo helps to increase the value of TowerCo. To remain attractive, the TowerCo will act on multiple angles:

- Find investment opportunities: As the field expands, competition will become tougher. The TowerCo will position itself well value intelligently by bidding. The company can expand its shares to own related assets such as fiber optic cables, data centers and undersea cables.

- Customer Operations Management: It is necessary to extend to managing the network's access layers, to manage active radio access network (RAN) equipment. Although carriers own the RAN, the market tends to outsource mining operations to focus on higher value-creating activities like 5G. The TowerCo can also use the revenue from the management and operation of the RAN, to finance other business projects.

- Digitize the process chain to improve service: TowerCos undertake RAN asset management or other activities, then digitizing those activities is important. Help reduce costs, focus resources on improving customer experience. Digitization also gives TowerCo the opportunity to find new business directions in the future.

As independent investors, many TowerCos have improved margins and gained more value by: optimizing leases, digitizing operating processes, using models Advanced pricing and leveraged procurement that support the portfolio.