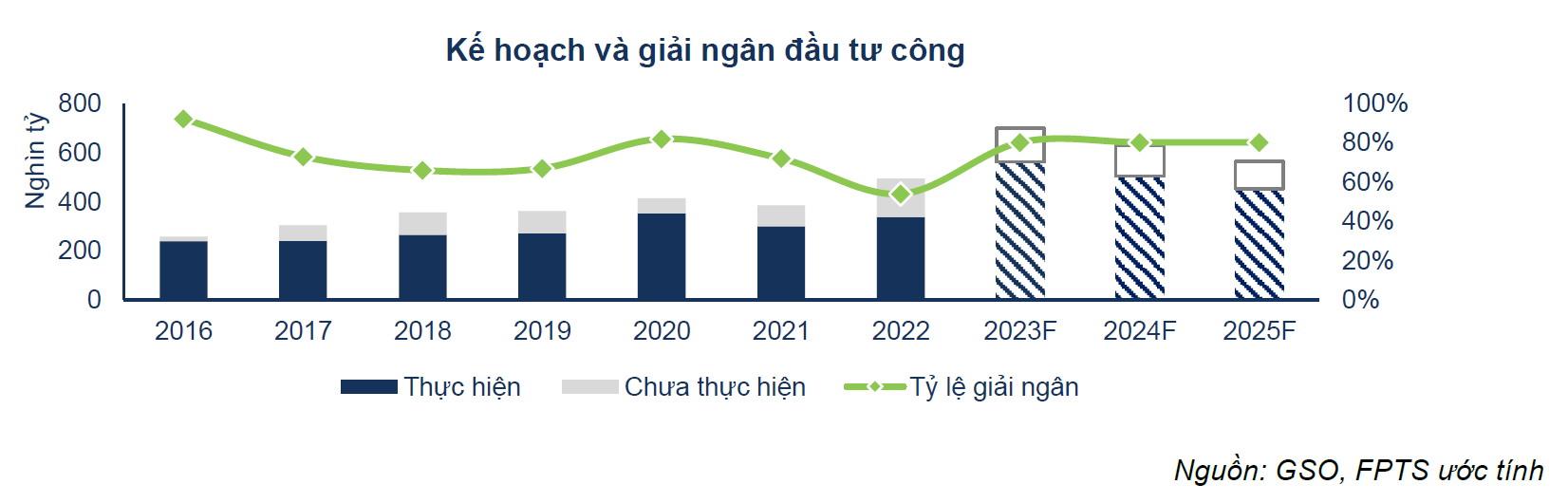

Public investment is expected to increase by VND 140,000 billion by 2023

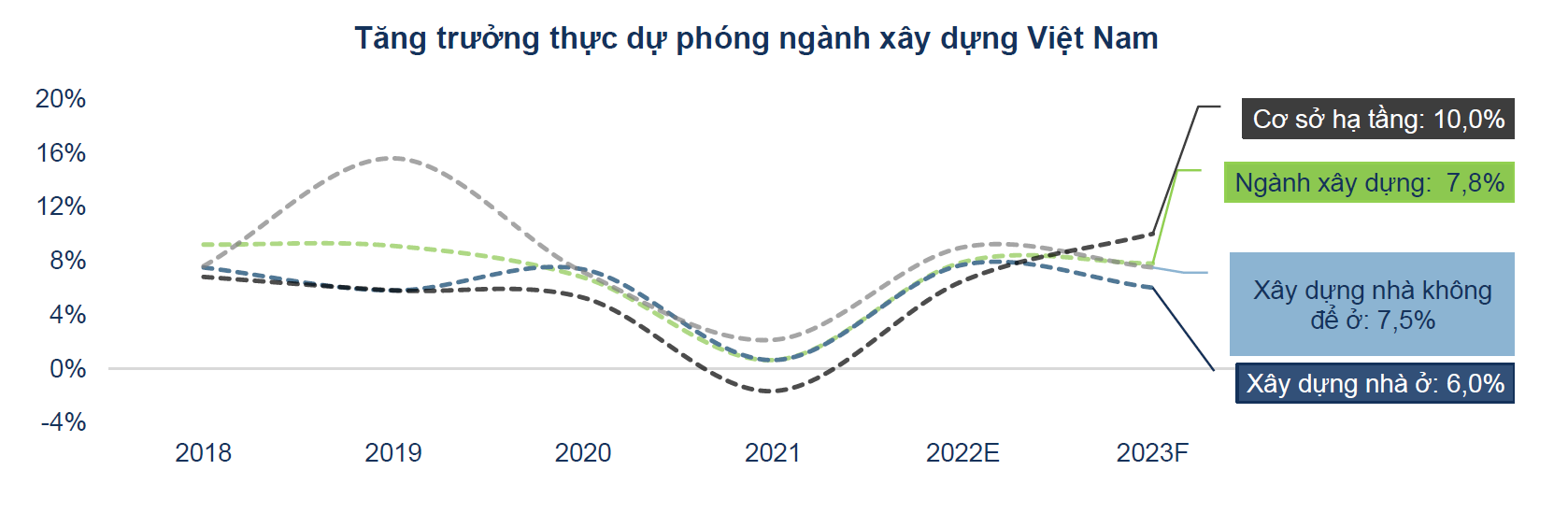

According to FPTS's analysis report, the real growth forecast of the construction industry in 2023 is 7.8%, of which the residential construction segment will reach 6%, non-residential housing 7.5% and infrastructure reach 10%.

In the year 2022-2023, the demand for investment in new construction is differentiated between construction segments. Disbursement of public investment is an important driver of growth in infrastructure construction in 2023:

- Part of the capital is expected to increase by 25% compared to 2022 from the medium-term public investment plan and the economic recovery and development program. The National Assembly approved a public investment plan in 2023 with a total capital of over 700 trillion VND, an increase of about 25% (about 140 trillion VND) compared to the plan in 2022 and an increase of about 260 trillion VND compared to the plan. 2021 (first year of the 2021-2025 medium-term public investment plan).

- Policies to improve disbursement progress when in 2022 only reach 52.43% because many projects have to stop construction because input costs are too high and problems in site clearance.

It is expected that in 2023, the construction industry will reduce the pressure on raw material prices when steel prices (accounting for ~40% of production costs) tend to decrease from the third quarter of 2022. World steel demand is low due to pressure from inflation, tightening monetary trend and China's real estate market will need a few more years to recover from the crisis; Supply chains resumed post-pandemic.

Cement prices will tend to adjust slightly lower than in 2022, but will still stay at a high level when the world and domestic coal prices are still unable to stabilize as before the COVID-19 epidemic. Lower material prices are expected to have a positive impact on profit margins of construction businesses.

According to VCBS, in the period 2021-2030, many localities have a strong orientation to expand their boundaries and establish new administrative-economic centers, thereby strongly attracting project development activities and bringing in resources. Big job for construction businesses.

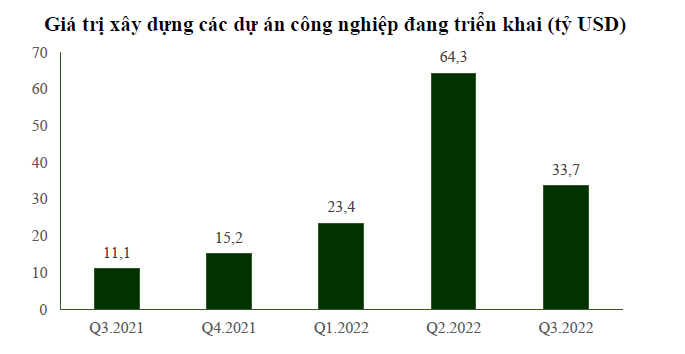

The bright spot in the industrial and infrastructure construction group

Compared with civil construction, the infrastructure and industrial construction sector is a bright spot with positive results in the first 9 months of 2022 thanks to the following factors:

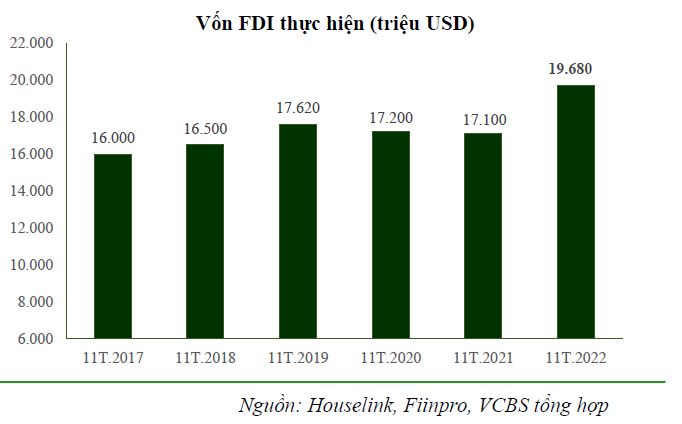

- The scale of realized FDI capital increased sharply from the beginning of 2022 when:

- Travel, signing contracts with foreign customers will resume when international routes are resumed.

- Many industrial parks have completed site preparation and are ready for lease.

- Plans to invest in factories and factories of domestic enterprises were promoted after the lockdown was lifted and anticipated the recovery demand of the economy.

- The cash flow efficiency in factories, warehouses and industrial park infrastructure projects is superior due to:

- Short construction time.

- Investors (especially FDI sector) often have abundant financial resources and advance most of their capital needs on schedule.

VCBS believes that conditions for construction activities will be significantly improved in 2023:

- After a strong interruption of the wave of unskilled workers returning to their hometowns during the lockdown period (the second half of 2021), by the end of the third quarter of 2022, the labor force had basically returned to a stable level.

- The weather cycle is forecasted to change to El Nino state (with low rainfall characteristics) from 2023, creating favorable conditions for construction activities, especially in transport infrastructure projects.

New construction and installation bidding packages in the investment cycle 2021-2025 will focus more on businesses with large scale and financial potential. This comes from:

- The scale of each construction and installation bidding package is significantly higher than the previous investment cycle due to the policy of not subdividing bidding packages to manage quality and filter out weak contractors.

- Contractors with good financial resources possess many advantages in:

- Maintain material purchasing activities and ensure construction progress even in adverse market price movements.

- Well positioned to negotiate with suppliers.