Vietnam is returning to pre-pandemic growth levels

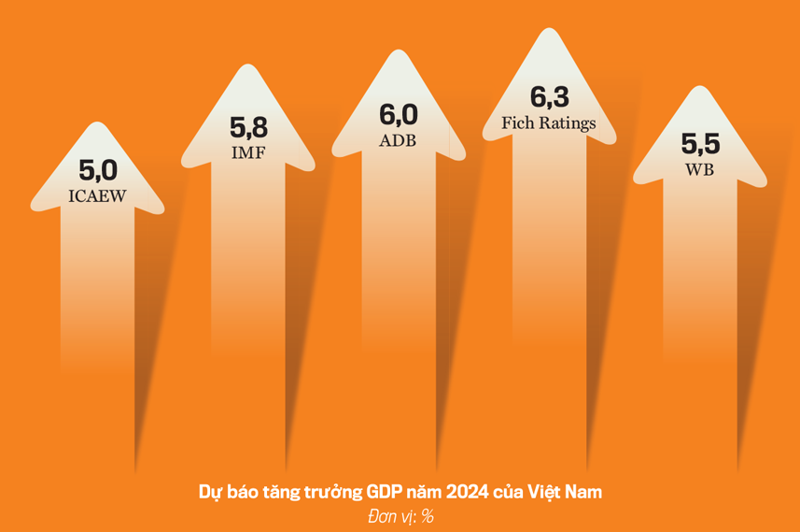

On Bloomberg (USA), there was a recent article with a positive forecast for the Vietnamese economy in 2024. Bloomberg commented that the State Bank of Vietnam is likely to keep the operating interest rate unchanged for the time being. next. Accordingly, Vietnam's economy will likely grow by 6.3% in Q1/2024 and 6.5% in Q2/2024. GDP growth is forecast at 6% in 2024 and 6.4% in 2025. In addition to bloomberg, organizations such as ADB and Fich Ratings all forecast Vietnam's GDP growth to fluctuate at 5 - 6.3%.

According to international organizations, Vietnam's growth prospects in 2024 and the medium term are assessed positively.

In general, according to international organizations, Vietnam's growth prospects in 2024 and the medium term are assessed positively, thanks to the recovery of domestic consumption, import and export of goods and promotion of public investment. , increasing foreign investment capital.

In the report forecasting the global economic outlook for the fourth quarter (December 2023), the Institute of Chartered Accountants in England and Wales (ICAEW) and Oxford Economics said that Vietnam's miraculous growth story is not yet over. . Although 2023 is a challenging year, looking at foreign direct investment (FDI) data, Vietnam recorded record FDI inflows at 23.2 billion USD, from 22.4 billion USD by 2022. This shows that companies still see value and opportunities in Vietnam and will continue to lay the foundation for many business activities in the following years. The increase in investment by multinational corporations will boost Vietnam's GDP growth to surpass that of other ASEAN countries, at least until 2030.

Vietnam real estate: Foreign investment destination in 2024

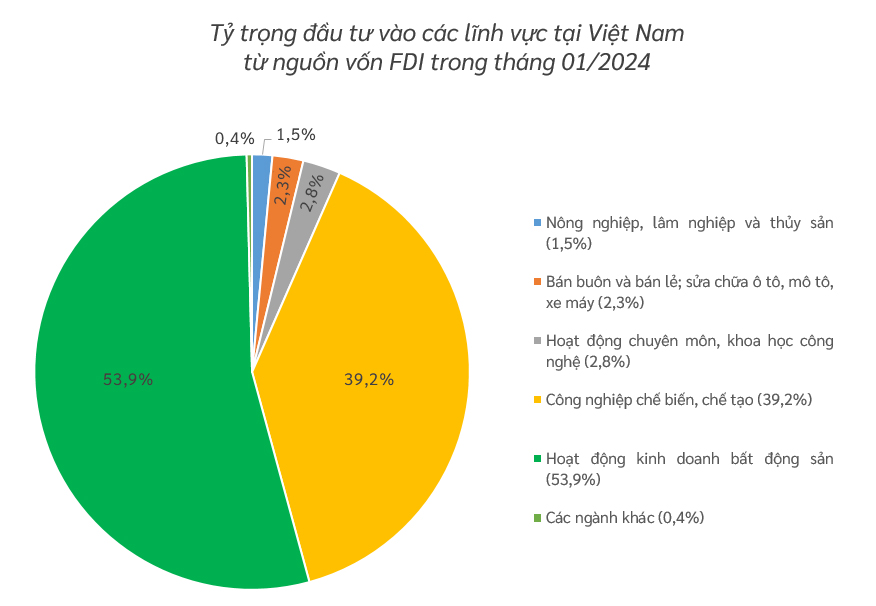

Theo số liệu từ Cục Đầu tư nước ngoài, Bộ Kế hoạch và Đầu tư, tính đến ngày 20/01/2024, tổng vốn đầu tư nước ngoài đăng ký cấp mới, điều chỉnh và góp vốn mua cổ phần, mua phần vốn góp của nhà đầu tư nước ngoài đạt hơn 2,36 tỷ USD (tăng hơn 40% so với cùng kỳ năm ngoái). Trong đó, tổng vốn đầu tư vào ngành kinh doanh bất động sản đạt hơn 1,27 tỷ USD, chiếm 53,9% tổng vốn đầu tư đăng ký.

Positive signals from the first month of the new year show that Vietnam is still one of the priority choices for foreign direct investment (FDI) flows in 2024.

CBRE Group (USA) recently announced the results of the survey "Intentions and plans of investors in the Asia-Pacific region in 2024". The report said that Vietnam's real estate market ranks second among the most sought-after emerging markets in terms of investment strategy and added value.

Most investors in Vietnam focus their attention on industrial and office real estate

According to the survey, investors consider the Vietnamese real estate market to have a unique context, where investment portfolios containing income-generating assets are scarce and often not offered much on the market. Most investors in Vietnam focus their attention on industrial real estate, offices and project land for housing development. They like to look for double-digit profit targets, so they have focused on properties of "landowners" who are facing legal difficulties or have problems paying debt. This trend highlights the resilience and attractiveness of real estate in Vietnam.

The Government accelerated disbursement of VND 657,000 billion for public investment

On February 16, 2024, Prime Minister Pham Minh Chinh, Head of the State Steering Committee for important national works and projects, key transportation sectors, chaired the 9th session of the Steering committee. The Prime Minister said that the whole country is promoting three growth drivers, including investment motivation, including domestic investment, foreign investment, private investment and social investment.

The Prime Minister emphasized that public investment plays an important role, leading and activating all social resources for development investment. In 2024, the whole country will spend 657,000 billion VND for public investment, mainly transport infrastructure investment and strive to achieve a disbursement rate of at least 95%. Of which, investment capital for transport infrastructure development dominates, amounting to 422,000 billion VND.

Bidding Law 2023 officially takes effect from January 1, 2024

According to the provisions of Clause 2, Article 10 of the 2023 Bidding Law, construction and installation bidding packages with a value of less than 05 billion VND are reserved for micro and small enterprises to participate in the bidding. However, in cases where bidding has been organized, if there are no micro-enterprises or small enterprises that meet the requirements, it is allowed to re-organize the bidding and allow other enterprises to participate in the bidding. This regulation will expand new opportunities and job sources for Viettel Construction Branches in 63 Provinces/Cities from 2024.

It can be seen that the market picture has many bright spots for Viettel Construction, as the Corporation possesses a foundation of experience and construction capacity of up to 28 years.

Viettel Construction's construction field is currently performing the following roles: implementing the construction of high-rise building projects, industrial park infrastructure, factories, large-scale low-rise civil construction and infrastructure works. traffic in Vietnam. This helps Viettel Construction reach a variety of fields and segments.

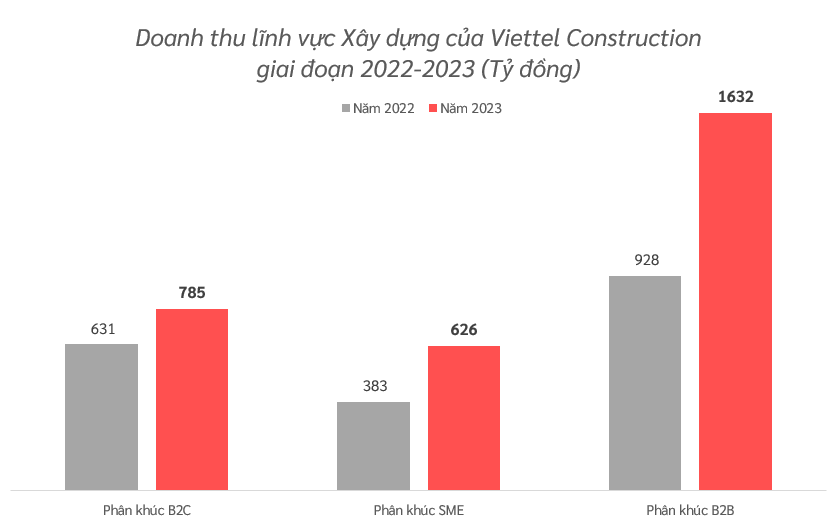

In 2023, Viettel Construction's construction sector earned VND 3,042 billion, of which the B2B, SME and B2C sectors accounted for 54%, 21% and 26% respectively. All three segments of Viettel Construction have double-digit growth compared to 2022, with the highest revenue growth of 76% from the B2B segment and 64% from the SME segment.

Viettel Construction's construction sector revenue in the period 2022-2023

The coverage rate of projects constructed by Viettel Construction will also increase significantly in 2023, when district coverage reaches 682/701 districts nationwide (equivalent to 97.3%); 2,535/10,609 communes (equivalent to 23.9%).

Viettel Construction focuses on bringing construction services to foreign markets. In 2023, Viettel Construction signed many valuable construction projects in Myanmar, notably Mytel's office building construction project worth more than 1 million USD.

In addition, the Corporation has a plan to establish a representative office in the Australian market, aiming to establish a member company in Kangaroo headquarters, a potential market for the construction sector.

Thus, Viettel Construction's attractive market opportunities and long-term approach strategy promise to help the Corporation conquer larger revenue milestones in 2024.