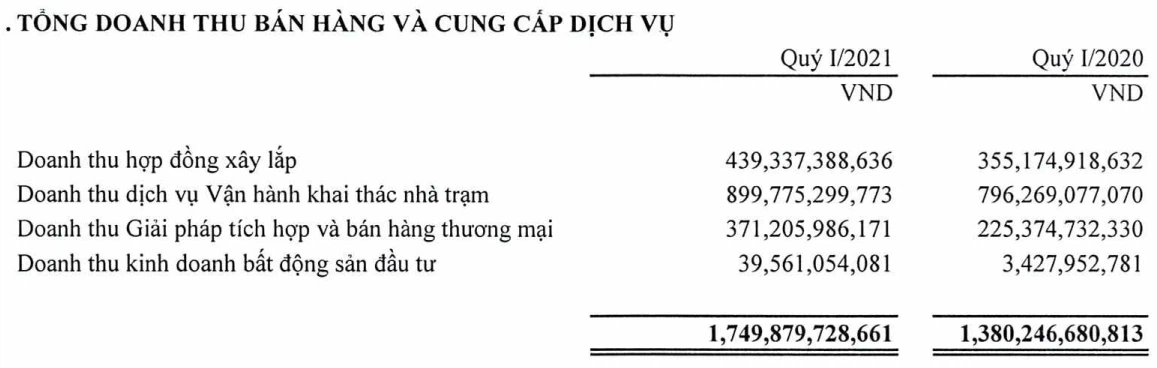

Viettel Construction Corporation - Viettel Construction (Stock code: CTR) announced its financial statements for the first quarter of 2021 with net revenue of VND 1,750 billion, up 27% over the same period last year.

In which, the business segments of Viettel Construction all had growth compared to the same period last year. Specifically, the station operation and exploitation segment still accounted for the largest revenue with 900 billion dong, up 13%; Construction and installation segment achieved revenue of VND 439.3 billion, up 24%; Integrated and commercial solutions achieved revenue of VND 371.2 billion, up 65%; Investment real estate segment (Towerco) had the strongest breakthrough when bringing in revenue of nearly 40 billion dong, 11.5 times higher than the same period last year.

Viettel Construction's gross profit in the period reached 124.1 billion dong, equivalent to a gross profit margin of 7.09%, improved compared to the gross profit margin of 6.33% in the same period last year.

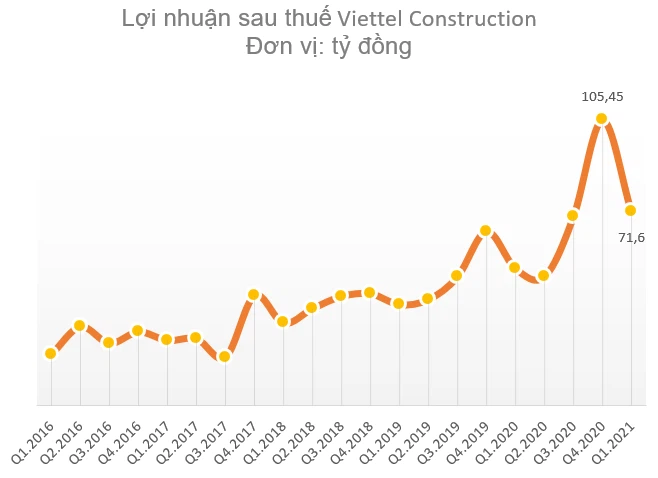

During the period, financial revenue (interest on deposits) Viettel Construction reached 2.08 billion dong, down 65% compared to the same period last year; Administration expenses increased by 25% to 35.65 billion VND. After deducting expenses incurred in the period, Viettel Construction recorded VND 71.6 billion in profit after tax in the first quarter of 2021, up 41% over the same period last year. This is also the second most profitable quarter of Viettel Construction, only after the fourth quarter of 2020 with VND 105.5 billion.

In 2021, Viettel Construction will present to shareholders a business plan with revenue of VND 6,600 billion and profit after tax of VND 275.8 billion. With the results of the first quarter, the company has temporarily completed 26.5% of the revenue target and 26% of the year profit target.

At the end of the first quarter, Viettel Construction's total assets reached VND 3,575 billion, including VND 605 billion in cash and equivalents. The company currently has relatively low debt with 105 billion dong.

The cost of investment real estate in the period increased by 47 billion VND compared to the beginning of the year to nearly 280 billion VND. This is mostly an investment in BTS station, serving rental infrastructure. The cost of tangible fixed assets (machinery and equipment) also increased by 148 billion VND compared to the beginning of the year to 691.3 billion VND. Short-term receivables decreased by 241 billion dong compared to the beginning of the year to 909 billion dong, most of which is receivable from Viettel's member units.

Viettel Construction is expected to pay 2020 dividend in June 2021 at the rate of 39.5%, including 10% cash dividend (1 share receives 1,000 VND) and 29.5% stock dividend . This is a higher dividend payout ratio than the plan approved at the AGM last year with only 26% (10% cash dividend and 16% stock dividend).