Viettel Construction Corporation (Viettel Construction; CK code: CTR) was established in 1995 with the role of in charge of the entire construction and installation of domestic and international telecommunications network infrastructure of Viettel Group. The Corporation is currently the number 1 unit in Vietnam in infrastructure investment and telecommunications operation and exploitation.

At the end of the trading session on June 2, 2023, the stock code CTR of Viettel Construction had a market price of 73,500 VND/share. At the 2023 Annual General Meeting of Shareholders, the Corporation's shareholders approved the plan to pay dividends in 2022 with a total rate of 31.51% (In which: 10% in cash and 21.51% in shares).

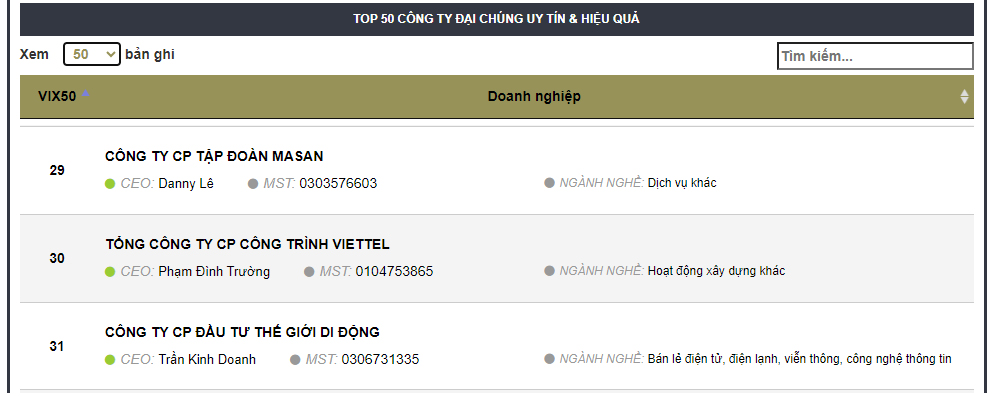

The ranking of Top 50 prestigious and effective public companies in 2023 is the result of independent and objective research by Vietnam Report. Inheriting research results from the top 10 ranking of prestigious "Enterprises" listed annually since 2016, based on Media Coding method in the media, combined with research specializes in key industries with high growth potential such as: Real Estate – Construction, Banking, Insurance, Pharmacy, Food – Beverage, Retail, Tourism, Logistics...

The media analysis research method to assess the reputation of companies is based on the Agenda Setting theory of professors Maxwell McCombs and Donald L. Shaw on the influence and impact of mass media on the community and implemented and applied by Vietnam Report and its partners since 2012. Accordingly, Vietnam Report has used the Branch Coding method (evaluating the company's image in the media) to conduct a reputation analysis. credit of listed companies in Vietnam.

In the first 4 months of 2023, Vietnam's stock market struggled to differentiate, alternating increases and decreases continuously with strong impacts from many domestic and foreign factors: the reopening of China, news about instability in the domestic market. the banking system in the US and Europe, the State Bank's supportive policies for the market, the reversal of net buying - net selling of foreign investors, etc. As of the end of April 2023, the VN-Index decreased. compared to the previous month, but compared to the beginning of the year, the stock indexes still maintained positive growth. Market liquidity was more positive when it saw the first monthly increase in 2023 after consecutive months of decline.

The constantly fluctuating state of the economy and the stock market requires the initiative to improve competitiveness and the ability to take advantage of opportunities for growth. Especially, when market confidence is at a low level, prestige and efficiency play a core role for public enterprises because it determines investor confidence, improves access to capital, and impacts on public enterprises. to market valuation, provide competitive advantage, and strengthen stakeholder relationships.

All 4 factors related to financial capacity indicators: Business results, Business performance, Basic earnings per share, Liquidity and corporate valuation are in the top 7 most influential factors. to the reputation and efficiency of public enterprises this year and recorded an increase in influence. Notably, Dividend policy (associated with corporate governance) has risen from the 8th position last year to the 6th most influential factor.

The results of a survey of experts and public enterprises by Vietnam Report also show that factors related to communication have the greatest impact on the reputation and efficiency of enterprises. The media can have a significant impact on public enterprises through: stock prices, public perception, stakeholder relationships and strategic decisions.